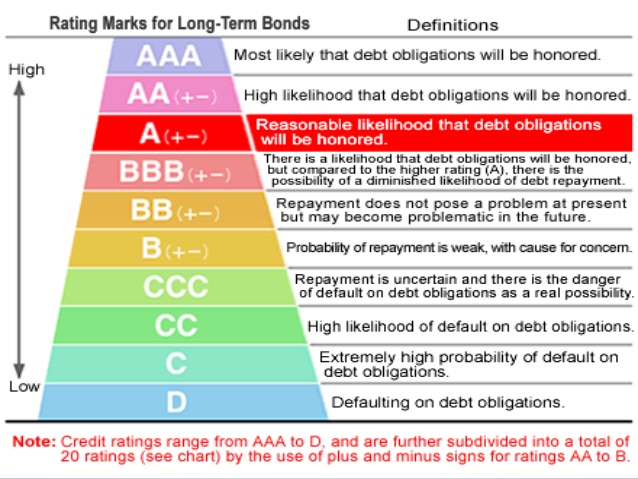

S&P reaffirmed OUIC's BBB rating with stable outlook

According to S&P assessment OUIC would remain appropriately solvent with sufficient resources to cover potential liquidity requirements even if the Sultanate of Oman were to default. Therefore they are affirming 'BBB' long-term ratings with stable outlook .

OUIC as the company is able to pass their sovereign default stress test, aided in particular by an investment portfolio with a significant weighting toward cash deposits with banks.

The stable outlook reflects their view that OUIC's investment portfolio will remain broadly in line with the current asset mix, and that cash deposits will continue to be placed with systemically important banks.

The outlook is stable. The affirmation follows S&P assessment of OUIC's resilience to a hypothetical default of Oman (foreign currency rating: BBB-/Stable/A-3). In their view, this stress testing has demonstrated the capacity of OUIC's shareholder's equity and investment assets to absorb losses in a sovereign default scenario. This means that S&P can rate OUIC above the sovereign rating level

Finally S&P continues to regard OUIC's business risk profile as fair, and its financial risk profile as moderately strong.